LMNP Tax Exemption: What Does It Mean

When it comes to property investment in France, LMNP (Location Meublée Non Professionnelle), or non-professional furnished rental, is an important tax exemption scheme that helps maximize income while reducing tax burden. What is LMNP, and how does it work? In this blog, we explain how this French tax rule benefits foreign investors, and how buying properties in France, whether in the French Alps or Cannes, is a smart move for those seeking tax advantages and rental income.

If you’re considering buying property in France, the LMNP (Location Meublée Non Professionnelle) tax exemption could be an excellent opportunity for maximizing investment. This tax scheme applies to non-professional furnished rentals, offering tax benefits that significantly reduce liabilities. The LMNP tax exemption is attractive for foreign investors, including those looking to buy property in France from countries such as the UAE, Qatar, Saudi Arabia, and more.

With LMNP, property owners can deduct a variety of expenses, such as maintenance costs, furniture depreciation, and mortgage interest. This makes it an appealing option for anyone purchasing a rental property in Cannes, the French Alps, or other popular regions in France. This blog explores what LMNP is, how it works, and why it’s an excellent choice for reducing income tax on rentals while earning from property investment.

LMNP in Action

What Is LMNP?

LMNP stands for Location Meublée Non Professionnelle, which translates to non-professional furnished rental. This tax regime allows you to rent out a furnished property and enjoy certain tax exemptions. In simple terms, if you buy property in France and rent it out fully furnished, LMNP helps save money on taxes and increase rental income..

LMNP and Tax Exemptions: How Does It Work?

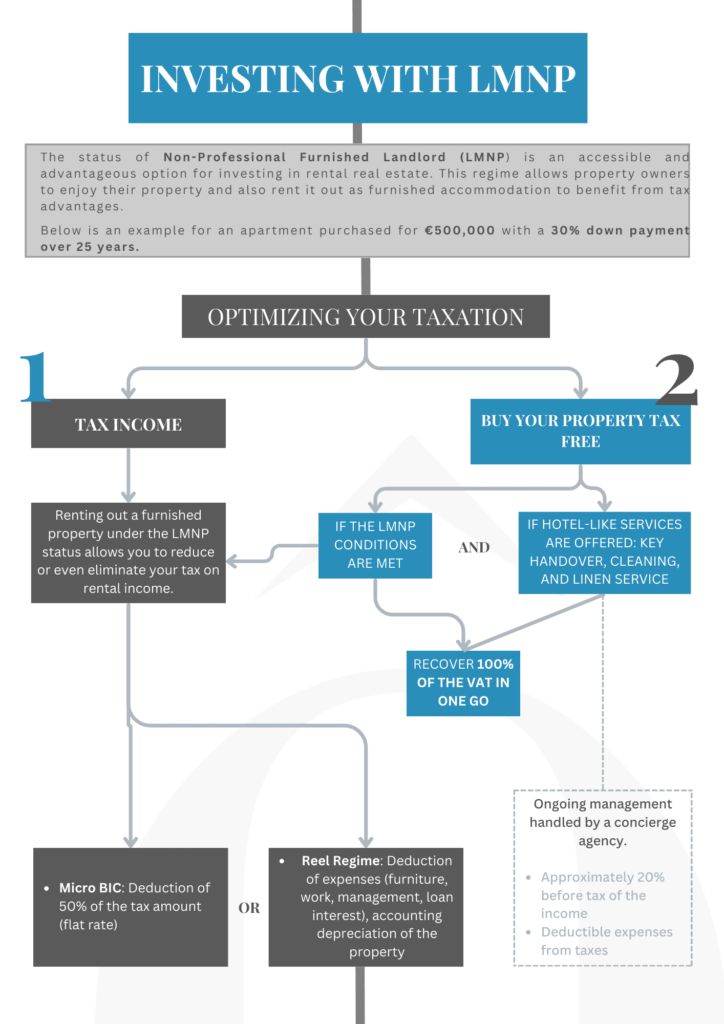

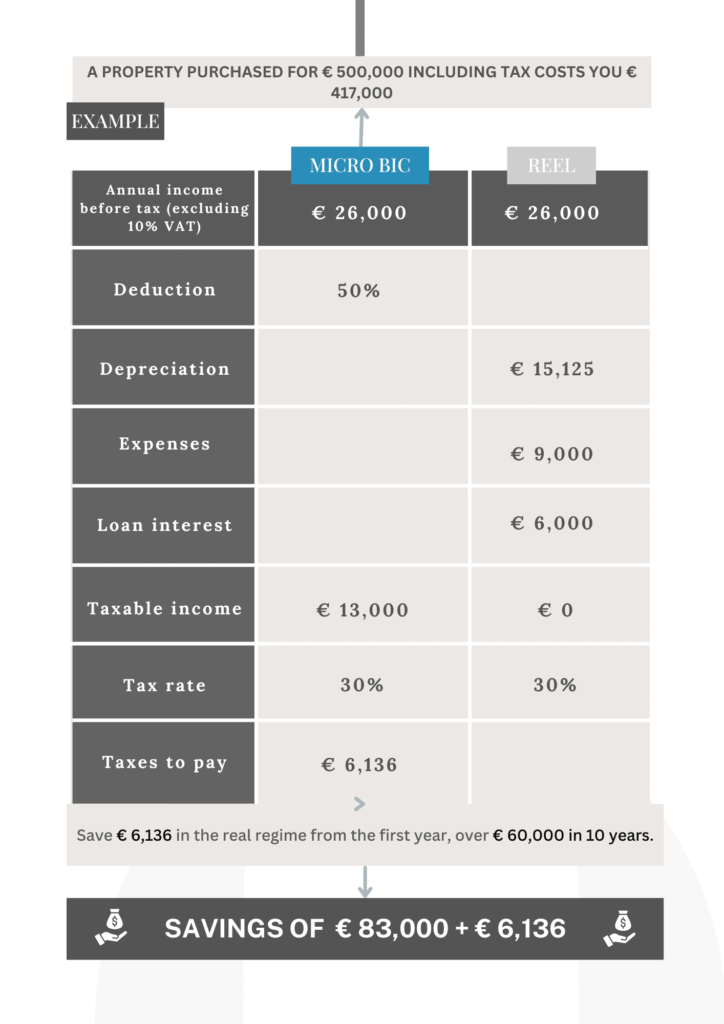

If you want to buy property in France and rent it out, the LMNP tax exemption offers an incredible benefit. Under LMNP, non-furnished rentals are subject to standard rental income tax rates, which can be high. Furnished rentals (like those offered through platforms such as Airbnb) fall under a special tax regime where you can deduct several expenses, reducing taxable income significantly.

For example, rental income from your property can be offset by various deductions, such as:

- Property management fees

- Maintenance and repairs

- Mortgage interest

- Depreciation of furniture and property

You won’t be taxed on the full amount of your rental income, and your tax burden could be lower than with traditional property rentals. This is a great opportunity for foreigners buying in France, whether you want to buy property in France from UAE, buy property in France from Saudi Arabia, or any other Gulf country like Qatar, Kuwait, or Oman.

Why Is LMNP Attractive for Investors?

If you’re buying property in France as a foreigner, LMNP offers a unique advantage. It reduces income tax on rentals and provides a more profitable way to earn money from your investment. The LMNP tax regime is designed to be investor-friendly, especially for those who aren’t property professionals but want to benefit from renting out their properties.

Many foreign investors, including those in Qatar, Saudi Arabia, and UAE, are looking at buying properties in French Alps or cities like Cannes. By opting for non-furnished rentals, you could unlock tax exemptions, making these properties more profitable in the long run. The beauty of this tax system is that it benefits those who might not rent out their properties year-round or aren’t full-time landlords.

How to Earn Money in France Through Rentals

If you’re wondering how to earn money in France, particularly through rentals in France, LMNP could be one of the most profitable routes to consider. French cities like Paris, Nice, and Cannes are ideal for buying properties and earning rental income. Many foreign investors looking to buy property in France from Kuwait or buy property in France from Bahrain are turning to short-term rentals and Airbnb properties in France. LMNP becomes incredibly beneficial.

By renting out your property as a furnished rental, you save on taxes and enjoy a higher return on investment (ROI). This is why the most profitable Airbnb in France often falls under the LMNP regime – it’s a win-win for both you as the investor and your tenants who get a furnished place to stay.

Can Foreigners Buy Property in France and Benefit from LMNP?

Absolutely! Foreigners buying in France can take full advantage of the LMNP tax exemption as long as they meet certain conditions. The great news is that even if you’re an American buying in France or a citizen of any other country, you can still use this system for rental properties.

To qualify, the property must be furnished and used primarily for rental purposes. As long as you adhere to the criteria set by the French tax authorities, you can enjoy the benefits of LMNP, including reduced income tax on rentals, and make money from your property investment.

How to Invest in France and Take Advantage of LMNP

If you’re considering investing in property in France, here are a few key steps to follow:

- Choose the Right Property – Whether you’re looking to invest in Cannes or the French Alps, the location will affect both the potential rental income and your eligibility for tax exemptions.

- Furnish the Property – To qualify for LMNP, your property must be furnished. This includes basic items like a bed, sofa, and kitchen appliances.

- Register as an LMNP Property Owner – Once you’ve purchased the property, you’ll need to register it under the LMNP tax system.

- Keep Records of Expenses – Be sure to document all expenses related to your rental property, including maintenance and repairs. This will help you maximize your tax deductions.

Conclusion: LMNP Makes Property Investment in France Even Better

Ready to start your property journey in France? At Vendome Property, we specialize in guiding foreign investors through the buying process and helping them navigate tax exemptions like LMNP. Let us help you make the most of your investment in the French real estate market!

FAQs:

What is LMNP?

A French tax regime for non-professional furnished rental properties, allowing tax deductions on rental expenses.Who can benefit from LMNP?

Anyone, including foreign investors from the UAE, Qatar, Saudi Arabia, and Kuwait, as long as they rent furnished properties.How does LMNP work for foreign buyers?

Foreign investors can reduce income tax on rentals by deducting expenses for furnished rental properties.Can LMNP reduce my income tax on rentals?

Yes, it allows deduction of rental expenses, lowering taxable income.Can foreigners use LMNP in France?

Yes, foreigners can use LMNP if they rent out furnished properties.What types of properties qualify for LMNP?

Furnished properties like vacation homes and Airbnb rentals qualify.

[…] Read Blog on Furnished rentals and how you can earn from your property Explore properties with lake geneva views […]

Solid points all around.